do nh residents pay sales tax on cars

What Are Some Loopholes to Avoid Paying Sales Tax on Cars. If a NH resident buys a car in MA does he have to pay state sales tax to MANH.

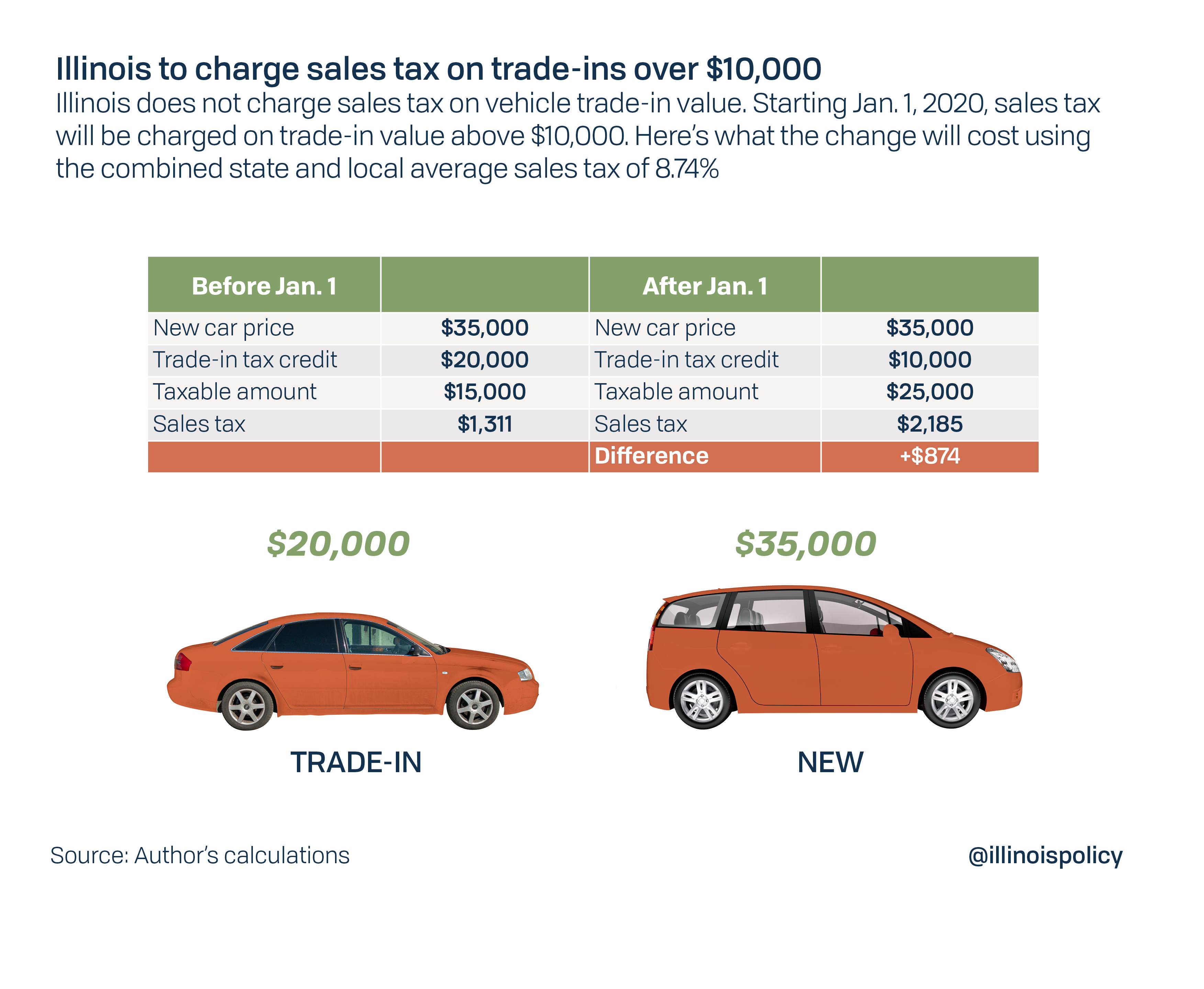

Illinois House Bills Would Reverse Pritzker S Car Trade In Tax

You only pay tax in the state that you register the vehicle.

. Maine collects a 55 state sales tax rate on the purchase of all vehicles. In addition to taxes car purchases in Maine may be subject to other fees like registration title and plate fees. Do New Hampshire residents pay sales tax on cars.

New Hampshire residents do not pay sales tax on a vehicle purchase. The actual sales price for the vehicle or. The New Hampshire state sales tax rate is 0 and the average NH sales tax after local surtaxes is 0.

Yes regardless of where you live if you purchase a car in MA you must pay the 625 percent sales tax in MA within 10 days if youre going to register in MA or within 20. No paper you pay sales tax then. As long as you are a resident of New Hampshire you wont need to pay sales tax on the purchase of your car even when you go to register it.

If so Max to either state. Purchase location does not determine sales tax for a vehicle state of registration does. If you purchase a vehicle in New.

As long as you are a resident of New Hampshire you wont need to pay sales tax on the purchase of your car even when you go to register it. For vehicles that are being rented or. Deleted 8 yr.

New Hampshire does not charge sales tax on vehicles. However only New Hampshire residents can purchase a vehicle in New. Connecticut charges 635 sales and use tax on purchases of motor vehicles.

A 9 tax is also assessed on motor vehicle rentals. The motor vehicles clean trade-in value. The answer is unequivocally no you will not have to pay Vermont sales tax when purchasing a car if you do not live in Vermont.

Five states do not charge sales tax on new or used car purchases. If youre getting it through a Massachusetts car dealer theyll know how do the. Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85.

Sales tax nexus is the connection between a seller and its local jurisdiction usually a state which requires the seller to register to collect and pay sales. Removed alwaysready 8 yr. The most straightforward way is to buy a.

If you are a New Hampshire resident registering your vehicle in New. As long as you are a resident of New Hampshire you wont need to pay sales tax on the purchase of your car even when you go to register it. Alaska Delaware Montana New Hampshire and Oregon.

The answer depends on whether the resident paid any sales tax to the state in which the vehicle was purchased. In maine you buy a car and you get a piece of paper that says you paid it then. However if you live in neighboring.

Sales taxes on cars are often hefty so you may try to avoid paying them. If you live in New Hampshire when you buy a car in Massachusetts you dont have to pay Mass sales tax. New Hampshire is one of only a few states without any sales tax including for vehicle purchases.

New Hampshire is one of the few states with no statewide sales tax. If a motor vehicle is casually sold not sold by a dealer or lessor the use tax rate is 625 of the greater of. Resident of NHno sales tax state buying car in NY.

However if you live in neighboring. States With No Sales Tax on Cars. Dealer or Private party.

Ford Courtesy Vehicle Inventory

5 States Without Sales Tax And What To Know About Them

Used Ford Fusion For Sale In Portsmouth Nh Edmunds

If I Buy A Used Car In Massachusetts And Register It In New Hampshire Do I Have To Pay Sales Tax Quora

If I Buy A Car In Another State Where Do I Pay Sales Tax

Used Ford Explorer For Sale In Portsmouth Nh Cargurus

Used 2019 Jeep Grand Cherokee For Sale In Epping Nh Cars Com

Used Ford Explorer Sport For Sale In Lowell Ma Cargurus

How To Avoid Paying Car Sales Tax The Legal Way Find The Best Car Price

New 2021 Ford Ranger Lariat For Sale In Salisbury Ma 1fter4fh7mld90194

New Hampshire Vehicle Sales Tax Fees Find The Best Car Price

What State Has No Sales Tax On Rvs Rvshare

New Hampshire Income Tax Calculator Smartasset

How To Qualify For The Vehicle Sales Tax Deduction Carvana Blog

Understanding New Hampshire Taxes Free State Project

Sales Tax Laws By State Ultimate Guide For Business Owners

Used Cars For Sale Near Manchester Nh Carsoup